FSM Social Security Administration

FSM Social Security Administration

Educating & Ensuring Social Security Benefits for all working citizens.

Category Archives: Public Announcements

- June 29, 2022

-

- March 23, 2020

-

- March 23, 2020

-

- March 19, 2020

-

- March 19, 2020

-

- March 19, 2020

-

- September 12, 2019

-

FSMSSA Employee Promotions

Category : Board News , Public Announcements

In February 2014, Robert Carlos (RC) began working at the FSMSSA as the Tax Assistant Officer. He had assisted the Tax Division in carrying out the duties of the division for years. Within the years he applied for another position in the Claims Division and was hired the Claim Analyst. As per duties differ in these Divisions, RC had different work experiences within the program divisions , which led him best qualified to be the new Claim Officer. Along with the qualities he possess and his work performance over the years, he had been promoted to be Claim Officer in May 2019. The Claim Officer reports directly to the FSMSSA Deputy Administrator. Responsibilities are to ensure that all claims made on FSM Social Security are processed in an entirely equitable, competent and on timely manner and that all beneficiaries of FSMSSA are treated strictly in accordance with the FSM laws and FSMSSA policies, processes, procedures and practices. The program looks forward to achieving its goals in terms referred to dealing with Claims within the Social Security System entrusting the work of this young man productively.

Briona Halverson had been with the program for over 10 years now. She began her experience with the FSMSSA Accounting Division as the Account Analyst. She had excelled with her duties in that division serving the program in so many years. With winds of change, she wanted to explore more and serve another division. Therefore, beginning May she started a new experience in the Claims Division as the Claim Analyst. The claim analyst is to assist the Claim Officer in ensuring that all aspects of FSM Social Security law and FSM Social Security Administration policies and practices, which relate to claims and associated matters, are rigorously conformed to at all times. With the skills and knowledge she possess, she is able to take on the new experience serving the claims division for all FSMSSA beneficiaries. She feels happy to be continuing serving the system under new job goals and her interest will surely assist her in support of task completions. FSMSSA looks forward to receiving good results as all employees always strive for to be better serving the FSM citizens.

- September 12, 2019

-

FSMSSA attends Public Hearing with Health & Social Affairs Committee

Category : Press Releases , Public Announcements

FSM Congress committee on Health & Social Affairs called for a public hearing on May 17, 2019. FSMSSA responded with the presence of Mr. Jack Harris, Chairman of the Board of Trustees, Board Member Mr. Nakama Sana, Administrator Alexander R. Narruhn, and Deputy Administrator Francky Ilai. FSMSSA comptroller Ms. Tessie Dayao was in attendance. Committee members present included Chairman Ferny S. Perman and member Paliknoa K. Welly along with two Congress Legal Counsels. The committee needed program updates especially on Financials of the FSMSSA. Administrator Narruhn presented figures that opens minds giving information that could be addressed to the whole Congress about the financial status of the FSM Social Security Program. With the exchange of questions and answers, both parties were satisfied on the given information, whereas, FSMSSA looks forward to the continuation of the subsidies given by Congress to support functions of the program, especially with any type of benefit.

- May 3, 2019

-

Beneficiaries to make Changes in Addresses

Category : Press Releases , Public Announcements

FSMSSA wishes to extend this announcement to all beneficiaries receiving benefits from the Social Security Program. Due to security reasons, the FSM Social Security Administration will be discontinuing the mailing of physical checks to overseas locations beginning April 2019. Therefore, beneficiaries residing outside of FSM must have a valid bank account to be used for benefit remittances. The program sincerely encourage ALL beneficiaries abroad and on the islands to abide with this recommendation in order to support security improvements. It must be a question raised to why the sudden change, yet due to incidents occurring with lost checks and more than that, FSMSSA intends to verify that the safest procedure is through bank direct deposits. This could also support the less use of paper for printed checks to thousands of beneficiaries. Moreover, the process is that you must have an active Savings or Checking Account. FSMSSA need your account information for confirmation then you could make the change. In doing so, our form had been sent out to all beneficiaries, it is as well posted on our website; www.fsmssa.fm. Please be informed that Joints accounts are applicable to only you and your spouse. On island beneficiaries are highly recommended to have accounts as much as possible. This change would really assist with systems expenses on its operations and a guaranteed timely payout to all beneficiaries and would highly shorten issues with physical checks. For further questions and comments, please contact us through e-mail or phone. Thank you.

- November 14, 2018

-

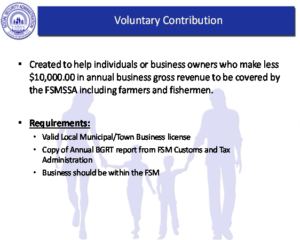

Introducing FSMSSA Voluntary Contributions through the Automated Clearing House (ACH) Program

Category : Press Releases , Public Announcements

The FSM Social Security Administration wishes to invite all interested FSM citizens working abroad to participate in the program. Public Law 14-86, which was passed on October 23, 2006, created a new provision within the social security law that would allow a citizen of the FSM working abroad to voluntarily contribute into the system to earn the right to benefits. FSM citizens who are actually working outside of the FSM, Palau or Marshalls can make voluntary contributions. In order for an abroad citizen to apply for Voluntary Contribution through the ACH, our official website – www.fsmssa.fm has prepared printable forms to (1) enroll in the program, (2) authorize the transactions, and (3) to authorize retroactive payments. Once these forms are filled and sent to the main office for processing, FSMSSA will collect their quarterly taxes from their account through online ACH. After every transaction, a receipt will be sent to the contributor while the bank documents the transfer in the contributor’s passbook.

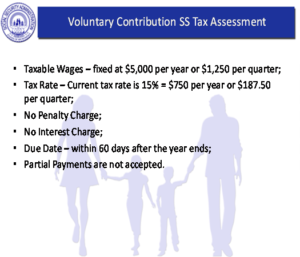

For persons who are self-employed or regular employees outside of the FSM, Republic of Palau and Republic of the Marshall Islands, they may make voluntary contributions to receive quarters of coverage and to accumulate payments to their minimum contribution requirements, even if they are contributing to another Social Security system. The person must make payments to FSM SSA in the FSM, and file a quarterly return. Any person making these voluntary contributions is subject to the same deadlines as any other taxpayer. The person must also pay both the employee and employer’s share of the social security tax. The quarterly earnings are fixed at $1,250.00

It applies also to FSM citizens now.

For persons who are self-employed sole proprietors with no employees in the FSM, which can include farmers and fishermen, and who make less than $10,000.00 per year, may make contributions to the Social Security System. The person will be deemed to make $1,250.00 per quarter, and they must pay the employee and the employer’s share. After January 1, 2013, the payment is $93.75 for the employee’s share and $93.75 for the employer’s share, totaling $187.50 per quarter. Any self-employed person electing to make such voluntary contributions must file quarterly returns and is subject to the same deadlines as any other taxpayer. If revenue received by a self-employed person is $10,000.00 or more, they are subject to the regular mandatory contribution provisions.